What is the Money Flow Index?

The Money Flow Index (MFI) is a technical oscillator that uses both price and volume data to identify overbought and oversold signals. It also detects divergences that may indicate upcoming trend reversals. The MFI oscillates between 0 and 100.

Unlike the Relative Strength Index (RSI), which uses only price data, the MFI incorporates volume — making it a volume-weighted RSI.

Key Takeaways

- The MFI generates overbought/oversold signals using both price and volume.

- Readings above 80 are considered overbought; below 20 are oversold. More aggressive traders may use 90/10 as thresholds.

- Divergences between MFI and price often suggest upcoming trend shifts.

When price rises from one period to the next, raw money flow is positive and added to positive money flow. If price drops, it contributes to negative money flow.

Higher typical price → positive money flow → buying pressure. Lower typical price → negative money flow → selling pressure.

These flows are used to calculate the money ratio, which is then used to compute the Money Flow Index (MFI), oscillating between 0 and 100.

Key Highlights

- MFI measures buying/selling pressure based on price and volume.

- Values range between 0–100.

- Above 80 = overbought (sell); below 20 = oversold (buy).

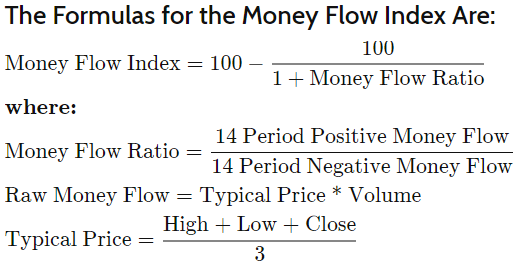

Formula for the Money Flow Index

1. Typical Price: (High + Low + Close) / 3

2. Raw Money Flow: Volume × Typical Price

3. Money Ratio: 14-period Positive Money Flow / 14-period Negative Money Flow

4. MFI: 100 – [100 / (1 + Money Ratio)]

MFI Signals

The MFI provides three main signals: overbought/oversold conditions, divergences, and failure swings.

Overbought/Oversold

An MFI above 80 may suggest a security is overbought. Below 20, it’s considered oversold. These thresholds highlight possible price extremes and potential reversals.

If MFI exceeds 90, it’s a very strong overbought signal; under 10 is a strong oversold signal — though these extremes are rare.

Divergences

Divergences occur when price and MFI move in opposite directions, often signaling a reversal.

Bullish Divergence

Price makes a new low, but MFI makes a higher low → buying pressure is increasing → possible bullish reversal.

Bearish Divergence

Price makes a new high, but MFI makes a lower high → buying pressure is weakening → possible bearish reversal.

Failure Swings

Unlike divergences, failure swings rely solely on MFI movement and signal potential reversals.

Bullish Failure Swing

- MFI drops below 20 (oversold)

- MFI rebounds above 20

- MFI pulls back but stays above 20

- MFI breaks above prior high → signal to buy

Bearish Failure Swing

- MFI rises above 80 (overbought)

- MFI falls below 80

- MFI rebounds but stays below 80

- MFI breaks below prior low → signal to sell

Related Concepts

- Volume Weighted Average Price (VWAP)

- Average Selling Price (ASP)

- Bullish vs Bearish Indicators

- Relative Strength Index (RSI)

Globals-AI

Globals-AI

Trading CFDs on leverage involves significant risk of loss to your capital. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Contact information

Phone number : ———

Customer Support Email: support@localhost

Risk Warning:

Please note, that we are providing the users of the Website with education services only which consist of various trading ‘training’ courses, including, but not limited to tutorials, blogs, education packages, and several levels of market coaching, offered solely for educational and training purposes on our Website, which you may purchase from the Company through the Website.

Trading in financial instruments involves high levels of risk. While we do not offer any trading services in relation with any financial instruments, it is important for us to highlight that you should not trade in any financial instruments, or deal with any financial services provider, unless you understand and can undertake all the risks involved. You are solely responsible to conduct your individual research before making any investment decision, and where appropriate obtain personal advice in this regard. We do not provide such advice, and you should consult independent advisors.

You must also note, that trading in financial instruments with any provider that you will chose involves a high level of risk. Trading in leveraged instruments (e.g. CFDs or forex contracts) involves an even higher risk of financial loss – leverage may work in your benefit, as well as against you. Trading in leveraged financial instruments may result in large financial loss (even of the entire amount of your investment). Before trading in any financial instruments, and even more so in leveraged financial instruments, you should make sure you fully understand, and can tolerate, the risks involved in trading. Trading in financial instruments is not suitable for all investors, and you are responsible to assess whether trading is suitable for you. We will not assess your personal situation (including financial situation) as we provide educational services only, and we cannot opine in the suitability of trading in general, or of trading in any particular financial instruments, might be suitable for you. We do not provide any trading, financial, tax or legal advice, and you should consult your own independent advisors before engaging in trading. Any information provided to you as part of our education services constitutes general information only, is not made personally for you, does not take into account your personal circumstances, and although it may contain certain predictions, does not include any guarantee that any such prediction should be correct or accurate. You are solely responsible to assess the quality of any information, as well as its appropriateness for your personal circumstances. We are not, and shall not be, responsible for any loss or damages you may suffer as a result of trading in financial instrument with any third party, or your reliance on any information, prediction, analysis or report provided to you. Do not trade with money which you cannot afford to lose. Or with borrowed money.